Adblocker Detected

We always struggled to serve you with the best online calculations, thus, there's a humble request to either disable the AD blocker or go with premium plans to use the AD-Free version for calculators.

Disable your Adblocker and refresh your web page 😊

Table of Content

Our MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System (MACRS).

The following methods are used by this calculator:

Before knowing about this modified accelerated cost recovery system (macrs) calculator, let’s start with the term ‘Macrs Depreciation.’

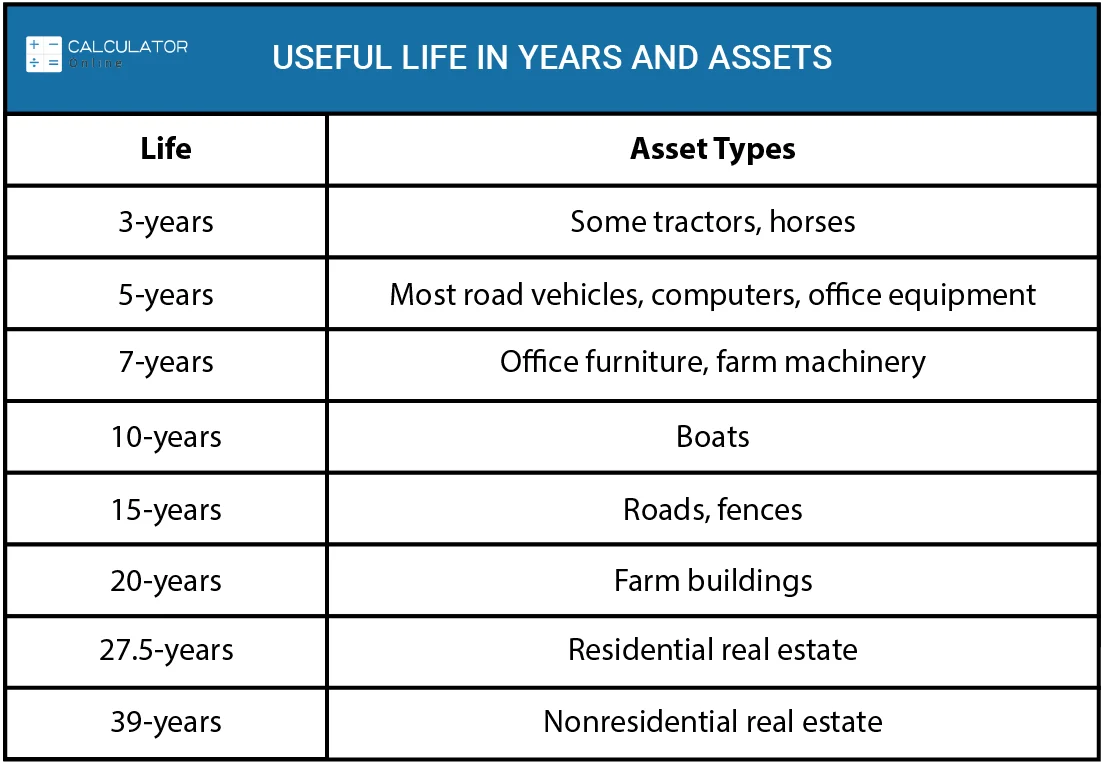

MACRS is an acronym for the Modified Accelerated Cost Recovery System; it is the tax depreciation system used in the United States. Well, this macrs depreciation schedule will begin with a declining balanced (DB) method, and then it will switch to a straight line (SL) schedule to finish the depreciation schedule. Under MACRS, the amount of the tangible property is depreciated over a useful life of the asset.

The Modified Accelerated Cost Recovery System was introduced in 1986, according to MACRs method; generally the property placed into service after the date will be depreciated. It is a modification of the ACRS (Accelerated Cost Recovery System) that was in use from 1981-1986.

Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion:

Di = C × Ri

Where;

Additionally, you can calculate the depreciation by considering the table factors listed in Publication 946 from the IRS. The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS.

Well, you ought to follow the given steps to calculate the depreciation schedule for depreciable property. Don’t fret, these steps are quite that helps you to perform macrs calculation.

Well, let us elaborate on the different methods for macrs depreciation!

Well, these are the MACRS depreciation methods that are based on the IRS (Internal Revenue Service). Read on to know about these methods. Calculating depreciation using macrs methods becomes easy with the ease of IRS depreciation calculator.

It is the macrs depreciation method in which the depreciation rate is double the straight-line depreciation rate and also provides the highest tax deduction during the first few years, and then changes to the SLD method when that method provides an equal or greater deduction. You just have to plug your values in the macrs calculator online and allow it to do the math for you.

It is another method that provides a greater depreciation rate of 150% more than the straight-line method and then changes to the SLD amount when that method provides an equal or greater deduction. Simply, account the macrs straight line depreciation calculator to calculate macrs.

The SLM (GDS) method is one of the best methods of depreciation that allows for a deduction of the same amount of depreciation every year but except the first and last year of service.

Our accurate macrs depreciation calculator account the macrs method of depreciation to calculate tax macrs depreciation. if you want to calculate macrs depreciation according to macrs method, then simply use the above calculator.

If you aim to select the correct macrs depreciation rate, you should have to stick to the following based on IRS Modified Accelerated Cost Recovery System MACRS schedule:

For instance:

Small business owners or certain owners may aim to account a smaller tax deduction in the early years, if they expect business profits to increase in later years or aim to show higher profits in earlier periods. Generally, it is best to choose the higher macrs depreciation rates in the earlier years for maximum tax savings.

From Wikipedia, the free encyclopedia – The Modified Accelerated Cost Recovery System (MACRS) – History – Depreciable lives by class – Depreciation methods – Special allowances and bonus depreciation – Alternative depreciation system – Example – Multiple-asset accounts – Retirement of MACRS assets – MACRS property classes table (From IRS Publication 946) – MACRS GDS property classes table – MACRS GDS property classes table – MACRS applicable percentage for property class – MACRS percentage for real property table (MACRS Depreciation Table)

For the source of corporatefinanceinstitute – How MACRS Depreciation Works – Depreciation Systems to Use with MACRS Depreciation – Property Classifications Under GDS – When ADS is Required by Law – Depreciation Methods Allowed Under MACRS