Adblocker Detected

We always struggled to serve you with the best online calculations, thus, there's a humble request to either disable the AD blocker or go with premium plans to use the AD-Free version for calculators.

Disable your Adblocker and refresh your web page 😊

Table of Content

The mpc calculator can assist you in finding your MPC ratio according to your changing disposable income. In the business world it can be one of the most essential calculations and you can’t survive in the competitive business environment.

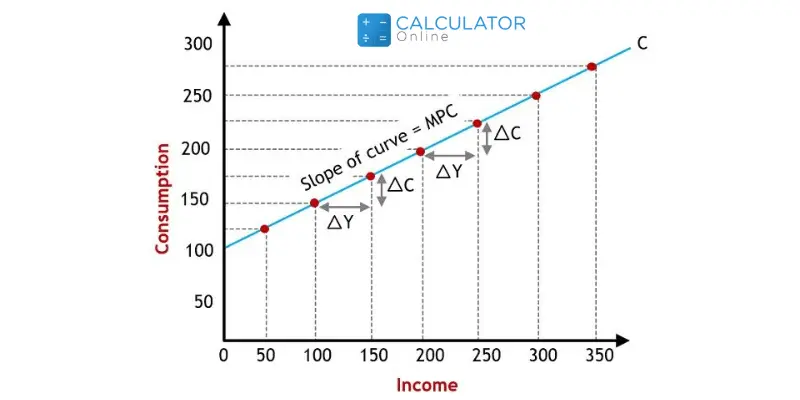

“Marginal Propensity to Consume is the change in consumption divided by the change in the income”.

Marginal Propensity to Consume is the amount of spending ratio with respect to your disposable income. The MPC is going to increase and decrease with the changing disposable income.

MPC=ΔC / ΔY?

Where:

ΔC= Change in consumption

ΔY= Change in the income

The mpc calculator is a simple way to find the mpc.

The MPC equation represents the tendency or Marginal Propensity,we can use the MPC values to evaluate the performance of business in a longer run. The MPC shows a clear picture of where a business is standing, and how it is performing in a sector.

The mpc equation is change in the tendency divided by the change in the income.

So

MPC equation=ΔC / ΔY

You don’t want to confuse yourself, What is MPC? For simplicity, you can say, It is a ratio between disposable income and spending expenditure. You can understand the concept of the MPC by a simple example, when your income increases,those who benefit from it, have a choice.

The choice is all about saving or sending, companies having a better ratio of the MPC have the option to increase or decrease their spending.The main reason for that is that their MPC ratio is better and they have a buffer to increase their spending to an extent.

The Marginal propensity formula for finding the financial strength of their business or another individual department performance:

Marginal Propensity to Consume = Change in Consumption / Change in Income

Companies have a better MPC ratio, have a competitive advantage, according to their requirements. Such companies have a choice to increase their spending on one of their conglomerates. They can increase their spending on their marketing or advertising company as compared to their competitor.

Consider the change in consumption is $900 in the same period for a company then the change in income is $1,500. The MPC calculator reflects the following ratio:

MPC = $900 / $1,500 =6%= 0.60

Thus, Marginal Propensity to Consume is 6% or 0.60.

Suppose a company ABC.Co generates an additional 10,000 dollars in their balance sheet, and the company decides to consume an additional 7,000 dollars as an expenditure.What is mpc for company ABC.Co?

Solution:

The disposal amount=$10,000

The additional spending of company=$7,000

how to calculate mpc:

Marginal Propensity to Consume = Change in Consumption / Change in Income

Marginal Propensity to Consume = $7,000/ $10,000

Marginal Propensity to Consume = 0.7%=0.07

For the company ABC.Co has an opportunity of extra 0.7% of spending

The marginal propensity calculator is an instrumental way to find MPC of a business.

The mpc calculation need following input values:

Input:

Output:

Calculate mpc, to find performance of a business.The marginal propensity to consume calculator represents following output data:

The high MPC indicates increase of income for a company and due to the high MPC the company can increase its spending or expenditure.

The low MPC is a representation that the company is not performing well and it needs to improve its processes to be competitive in the marketing environment.

The 8% increase mpc means that the company has a cushion of 8% to increase its spending.

The 30 % of the MPC means the company is performing tremendously in a competitive marketing environment. Calculate marginal propensity to consume and find the performance of a company.

The marginal propensity to consume can also be used for a commonplace person, increasing and decreasing trends directly related to our expenditure.When we are calculating mpc, it means we are determining the economic condition of a family.

MPC is a ratio as it is representing the ratio between the disposable income and company’s expenditure.The mpc calculator provides us critical information to analyze the performance of business.

We need to calculate marginal propensity to consume(MPC) for determining the performance of an organization in a specific business environment.MPC calculation is critical for the business analyst as we are using disposable income instead of income by the autonomous consumption calculator. This is the main reason it is a more accurate representation of a business than any other economic indicator for a company.

From the source of the investopedia.com:Consume (MPC),MPC and Economic Policy

From the source of the boycewire.com :What is Marginal Propensity to Consume, Factors that affect Marginal Propensity to Consume